maryland digital advertising tax effective date

Over the past year similar legislative proposals have been introduced in several other states but have failed to advance. The District of Columbia jumped on the digital ad tax bandwagon in 2020 but jumped off after discovering a problem with its proposal.

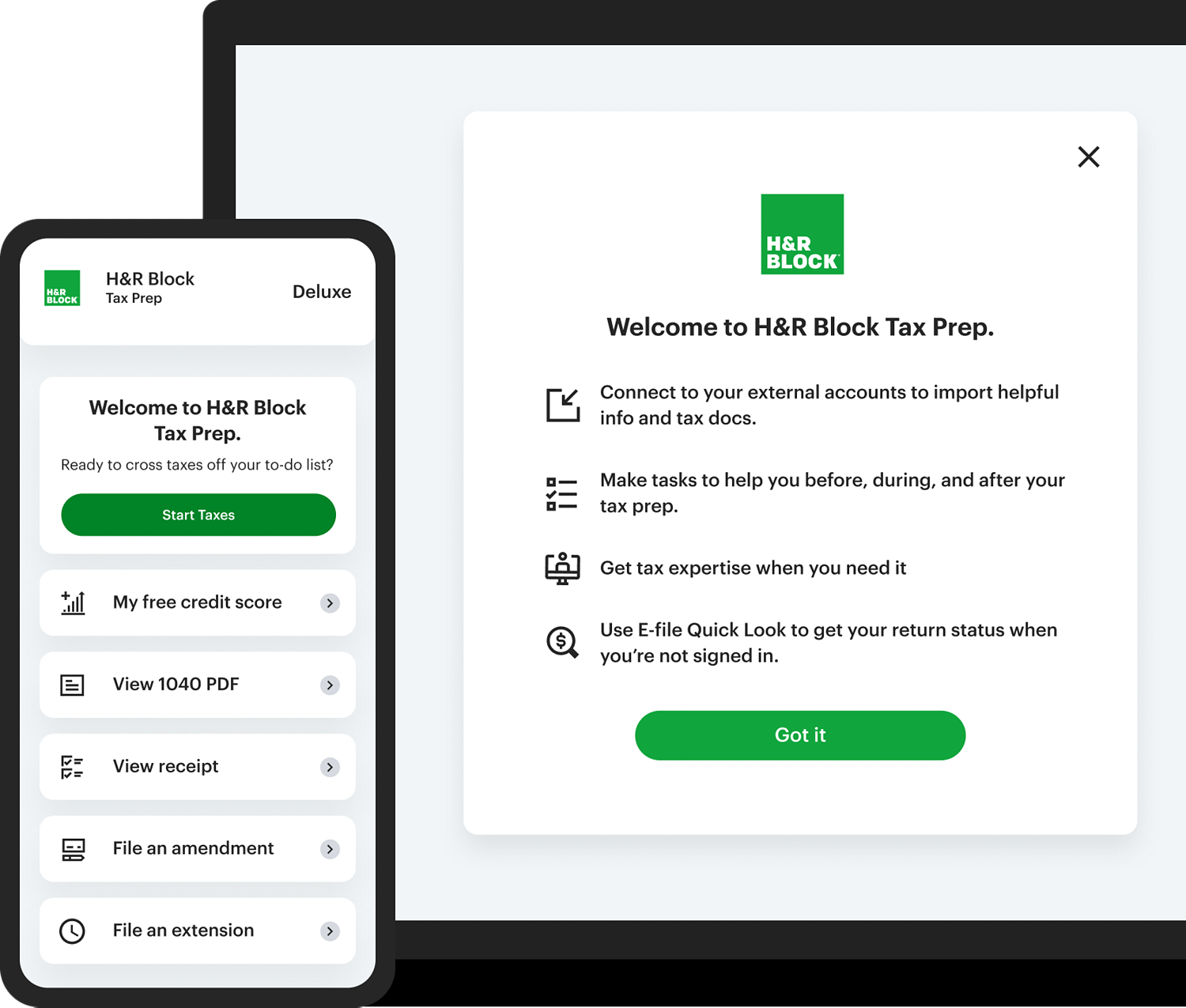

Tax Filing Options 2022 H R Block Newsroom

Digital advertising tax amendments.

. In February the Maryland General Assembly overrode Hogans 2020 veto of the tax allowing the tax to become law for. Digital advertising tax amendments. A bill that would amend.

Marylands Digital Advertising Gross Revenues Tax HB 732 was voted into law by the states General Assembly on Feb. But legislators punted several crucial questions to the state comptroller who. One is a sales tax on digital products and the other is a digital advertising tax.

To date Maryland is the only US. This page contains the information you need to understand file and pay any DAGRT owed. Marylands new tax is a law and it will be implemented.

Larry Hogan that make major changes in the states tax code. Recall that the digital advertising tax is imposed on entities with at least 100000000 of global annual gross revenues and with at least 1000000 of digital advertising revenue derived from Maryland. On February 12 2021 Marylands General Assembly enacted two bills over the veto of Gov.

Three Issues with Proposed Regulations for Marylands Digital Advertising Tax. 732 2020 the Maryland Senate on February 12 2021 passed the nations first state tax on the digital advertising revenues. This amendment would not delay the effective date of the tax it only changes the applicable tax year 2021 to 2022.

Connecticut Indiana Massachusetts Montana New York Texas Washington and West Virginia all introduced digital advertising tax bills in 2021. On November 24 2021 the Office of the Comptroller of Maryland MD Comp adopted final regulations outlining how the states new tax on gross revenues from digital advertising services DAT will operate Md. The Maryland legislature overrode Governor Larry Hogans veto of a new tax on digital advertising HB.

Digital Products and Digital Codes The new legislation excludes certain prerecorded and live instruction seminars discussions or similar events from the definition of a digital product. The Maryland gross revenues digital advertising tax became effective for tax years beginning after December 31 2021. The Comptroller of Maryland does not expect to issue additional guidance for the digital advertising services tax until at least July 2021.

The tax is applicable to all taxable years beginning after December 31 2020. Maryland recently became the first state to impose a tax on gross revenue from digital advertising which is set to take effect on January 1 2022. Importantly Senate Bill 787 would push the effective date of the tax on gross revenues from digital advertising services to tax years beginning after December 31 2021.

Maryland Passes Digital Advertising Tax Now Being Challenged in Court. If it does affected taxpayers have little time to determine which services are subject to. As mandated by the Maryland Constitution the tax will take effect in 30 days.

932 expands the existing sales and use tax base to include digital products effective March 14 2021. In February the Maryland General Assembly overrode Hogans 2020 veto of the tax allowing the tax to become law for the 2021 calendar year. Maryland has now enacted the nations first gross receipts tax targeted on digital advertising.

The new tax on revenue earned from digital advertising applies a graduated rate based on the taxpayers global annual revenue. March 01 2021 Updated April 29 2021 Update The Maryland legislature passed SB. The first bill HB.

Legislation is pending in Maryland Senate Bill 787 that revises tax laws enacted earlier this year when the General Assembly overrode vetoes of two 2020 bills. The first estimated quarterly payment at least 25 of the reasonably estimated tax based on 2021 Maryland digital ad tax revenues. Persons with global annual gross revenues equal to or greater than 100000000 must pay a tax on the portion of those revenues derived from digital advertising services in the state of Maryland.

787 which makes changes to the Digital Advertising Gross Revenue Tax including moving the effective date to tax years beginning after December 31 2021 as well as a provision that prevents the tax. Wednesday March 17 2021. The first bill HB.

932 expands the existing sales and use tax base to include digital products effective March 14. The tax is imposed on entities with global annual gross revenues of at least 100 million that have annual gross revenues derived from digital advertising services in Maryland of at least 1 million in a calendar year. One is a sales tax on digital products and the other is a digital advertising tax.

Review the latest information explaining the. Overriding the governors veto of HB. Larry Hogan that make major changes in the states tax code.

03120101 - 03120106 Final RegulationsThe DAT is currently scheduled to take effect on January 1 2022 and will apply to. State Local Tax SALT On Feb. Key aspects of Marylands new tax The newly enacted tax law defines digital advertising services to.

State with a tax on digital advertising. 12 2021 Marylands General Assembly enacted two bills over the veto of Gov. 732 on February 12 2021 making Maryland the first state in the country to adopt a tax on digital advertising.

Recall that the digital advertising tax is imposed on entities with at least 100000000 of global annual gross revenues and with at least 1000000 of digital advertising revenue derived from Maryland. It is scheduled to take effect by March 14 and that seems unlikely to change as of today. Marylands digital advertising tax is scheduled to take effect March 14 2021.

Of February 12 2021 is later than the effective date of July 1 2020 HB 732 now becomes effective March 14 2021 and appl ies to taxable years beginning after December 31 2020. Earlier this year Maryland legislators overrode Governor Larry Hogans R veto of HB732 approving a digital advertising tax the first of its kind in the country.

Pennsylvania Property Tax H R Block

Learn About Taxes And Business Losses H R Block

Time To Care Act After Advances In House Amid Significant Changes

Recent State And Local Tax Developments

Maryland Breaks New Ground In Taxing The Digital Realm Pwc

Consumer Credit Regulation Nclc Digital Library

Direct Sellers And Taxes How Does It Work H R Block

Tennessee Taxes Do Residents Pay Income Tax H R Block

Is Your Inheritance Considered Taxable Income H R Block

Pennsylvania Sales Tax Small Business Guide Truic

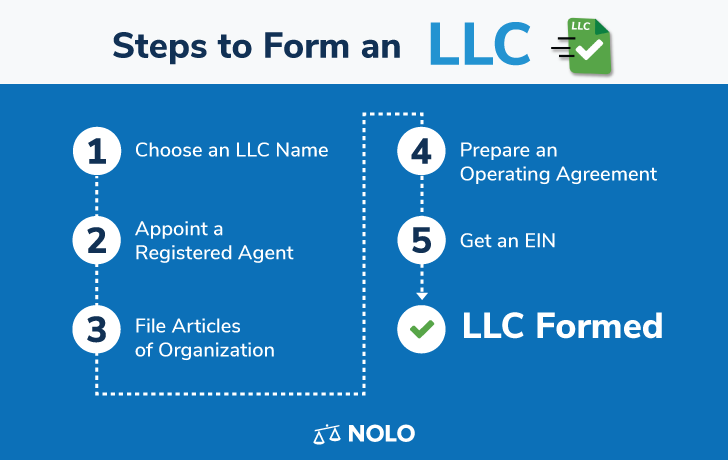

Llc In Pennsylvania How To Form An Llc In Pennsylvania Nolo

Marketing Assistant Resume Examples And Templates That Got Jobs In 2022 Zippia

How To File Taxes As An Independent Contractors H R Block

Recent State And Local Tax Developments

Tax Guide For 2022 Top 10 Planning Considerations Grant Thornton

Deluxe Online Tax Filing E File Tax Prep H R Block

Maryland Tax On Digital Advertising Services Enacted Kpmg United States

Beware B2b Sales Tax And Changes Amid The Cloud And Covid Digital Commerce 360