will child tax credit continue in 2022

Meanwhile 10 states are granting tax credits with the amount of the benefit and qualifying restrictions varying by state mostly based on the age of the children and household. In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three children maximum 750.

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

If the Senate fails to pass the current Build Back Better Act the monthly disbursements will not continue through 2022.

. The good news is. This credit is also not being paid in advance as it was in 2021. Under the presidents plan your estimated 2022 child tax credit would still generally be based on your most recent tax return.

Heres who qualifies PDF. States Offering Child Tax Credits in 2022. Losing it could be dire for millions of children living at or below the poverty line.

If you have a newborn child in December or adopt a child you can claim up. Child tax credit payments in 2022 will revert to the original amount prior to the pandemic. But without intervention from Congress the program will instead revert back to its original form in.

Sanders move to push for the tax credit of 300 per month for the next five years after it lapsed near the end of 2021 drew pushback from Democrats he. Government disbursed more than 15 billion of monthly child tax credit payments in July to American families. We dont make judgments or prescribe specific policies.

The child tax credit isnt going away. The Build Back Better Act stalled in the Senate and now Congress is on holiday. As of right now the Child Tax Credit will return to the typical amount 2000 per dependent up to age 16 for the 2022 tax year and there will be no advance payments offered to families.

Eligible families can now apply for a one-time tax rebate to receive 250 for each child under age 18. The way it looks right now the increased child tax credits wont be continuing into 2022. The American Rescue Plan included a 300 a month child tax credit which ended up lowering the child poverty rate in America by over 40 percent Sanders added noting his amendment would.

Get Rid Of The Guesswork And Have Confidence Filing With Americas Leader In Taxes. Several researchers have attempted to evaluate the effectiveness of the expanded child tax credit. This means that next year in 2022 the child tax credit amount will return to pre-2021 levels that is up to 1800 per child for children under six years of age and up to 1500 per qualifying child for children aged six to 17.

Ad Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly. President Bidens 2 trillion Build Back Better social spending bill would have continued the the Child Tax Credit through 2022. In order to be eligible for the Child Tax Rebate please remember to file your tax year 2021 Personal Income Tax Return by August 31 2022 or if you have.

Is the Child Tax Credit Going Away in 2022. An increase in the maximum credit that households can claim up to 3600 per child age five or younger and 3000 per child ages six to 17. Theres a plan to extend the credit but politics is getting in.

The rebate caps at 750 for three kids. 1 hour agoNew Jersey. In the meantime the expanded child tax credit and advance monthly payments system have expired.

Will i get the child tax credit if i have a baby in december. For 2022 that amount reverted to 2000 per child dependent 16 and younger. Since Congress did not extend the higher child tax credit amounts CTCs revert back to 2000 per child.

President Biden wants to continue the child tax credit CTC payments. Losing it could be dire for millions of children living at or below the poverty line. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics.

Part of the American Rescue Plan passed in March the existing tax credit increased from 2000 per child to 3600 per child under the age of 6 with 3000 for children between 6 and 16 years of. This means that the credit will revert to the previous amounts of 2000 per child. Everything is included Premium features IRS e-file 1099-MISC and more.

ANY hope of receiving a child tax credit payment in January 2022 is slowly slipping away as Congress holds the key to more money for Americans. The future of the monthly child tax credit is not certain in 2022. The newly passed New Jersey Child Tax Credit Program gives families with an income of 30000 or less a refundable 500 tax credit for each child under 6 years old.

The Child Tax Credit will continue in 2022 just without the expanded measures from the American Rescue Plan. Lastly Congress changed the payout structure so that households had the option of receiving the credit in monthly installments. The plan was always for another payment to be made in April.

Here is what you need to know about the future of the child tax credit in 2022. In fact the boosted Child Tax Credit is pretty much off the table for 2022 as lawmakers were unable to pass a spending bill that allowed for the enhanced version to remain in. The future of the monthly child tax credit is not certain in 2022.

Within those returns are families who qualified for child tax credits CTC worth up to 3600 per child but you can still receive up to 2000 per child for 2022. Ad File State And Federal For Free With TurboTax Free Edition. If you didnt receive one or more monthly advance Child Tax Credit payments in 2021 for a qualifying child you can still receive those payments and the remaining amount of your credit by claiming the Child Tax Credit for that child when you file a 2021 tax return during the 2022 tax filing season.

Not only that it would have modified it to include the following. See what makes us different. The Child Tax Credit has been cause for a lot of confusion as families look to file their 2021 return.

Child Tax Credit has now been reduced to a limit of 2000 per child causing many families to struggle to make ends meet.

2022 Nahma Ahma Education Event Calendar Nahma

How To Get Up To 3 600 Per Child In Tax Credit Ktla

Will Monthly Child Tax Credit Payments Be Renewed In 2022 Kiplinger

Child Tax Credit 2022 How Next Year S Credit Could Be Different Kiplinger

Canada Child Benefit Payment Dates 2022 Filing Taxes

Child Tax Credit 2022 What Changes Will There Be In The New Tax Season As Usa

Stimulus Checks 2022 First Tax Rebate Payments Going Out Who Is Eligible For The Money Cnet In 2022 Send Money Money Rebates

First Month Without The Expanded Child Tax Credit Has Left Families In Distress Npr

New 2022 Irs Income Tax Brackets And Phaseouts For Education Tax Breaks

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

Child Tax Credit Ending Will Push 10 Million Kids Back Into Poverty

Child Tax Credit 5 Things You Need To Know In 2022 Gobankingrates

Canada Child Benefit Increase What Will Your Monthly Ccb Be Planeasy

Restaurants Seek Input Tax Credit Low Interest Loans From Budget 2022 In 2022 Budgeting Low Interest Loans Tax Credits

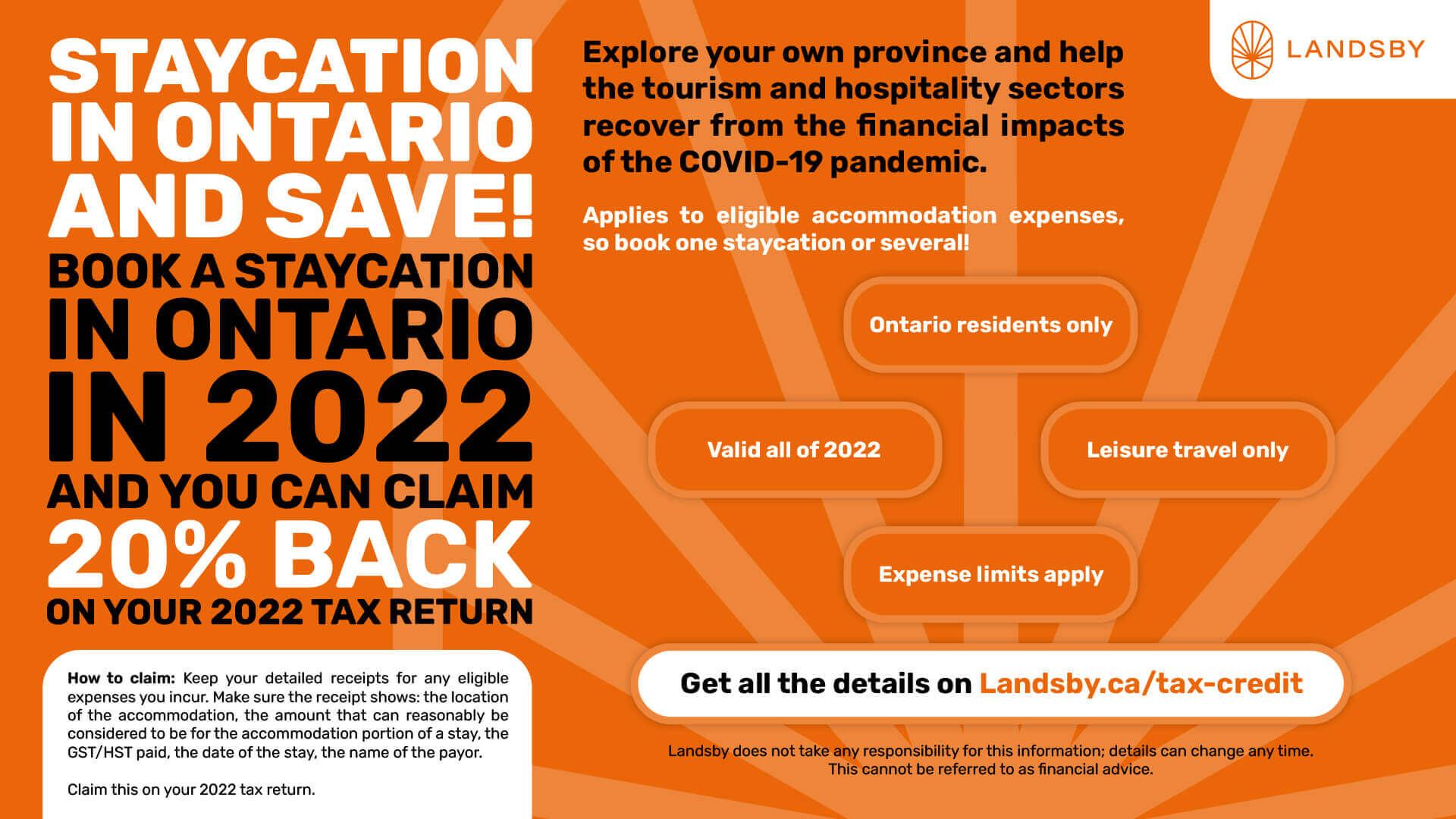

2022 Ontario Staycation Tax Credit Guide Landsby

Child Tax Credit Payments In 2022 Could You Receive 750 From Your State Cnet

Child Tax Credit 2022 Will Ctc Payments Finally Be Extended Marca